Low Oil Prices and Impact on the Oil Industry

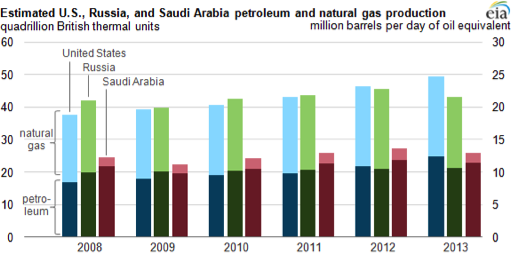

After several years of relative price stability, the oil markets sailed into a perfect storm in the second half of 2014. High growth in supplies met with low growth in demand. Global oil supply was supported by production from U.S. tight oil plays, which exceeded 4 million barrels per day in 2014 — barrels that were not being produced in any large volumes just five years ago. In addition, Libyan supplies returned to the market more quickly than anticipated, despite continued unrest within the country, adding yet more barrels to OPEC’s 30+ million barrels per day of output. And then negative data on economic growth from China, Europe and Japan triggered downward revisions to oil demand outlooks. The surplus of supply relative to demand on the world market then triggered a sharp drop in prices. The global benchmark Brent crude oil fell from an average price of $112 per barrel in June to less than $50 at the time of this writing. This 60 percent drop is approaching the severity of 2008’s 70 percent drop. The jolt to the markets is real. And past experience reveals that lower price levels tend to be accompanied by greater price volatility. The combination…