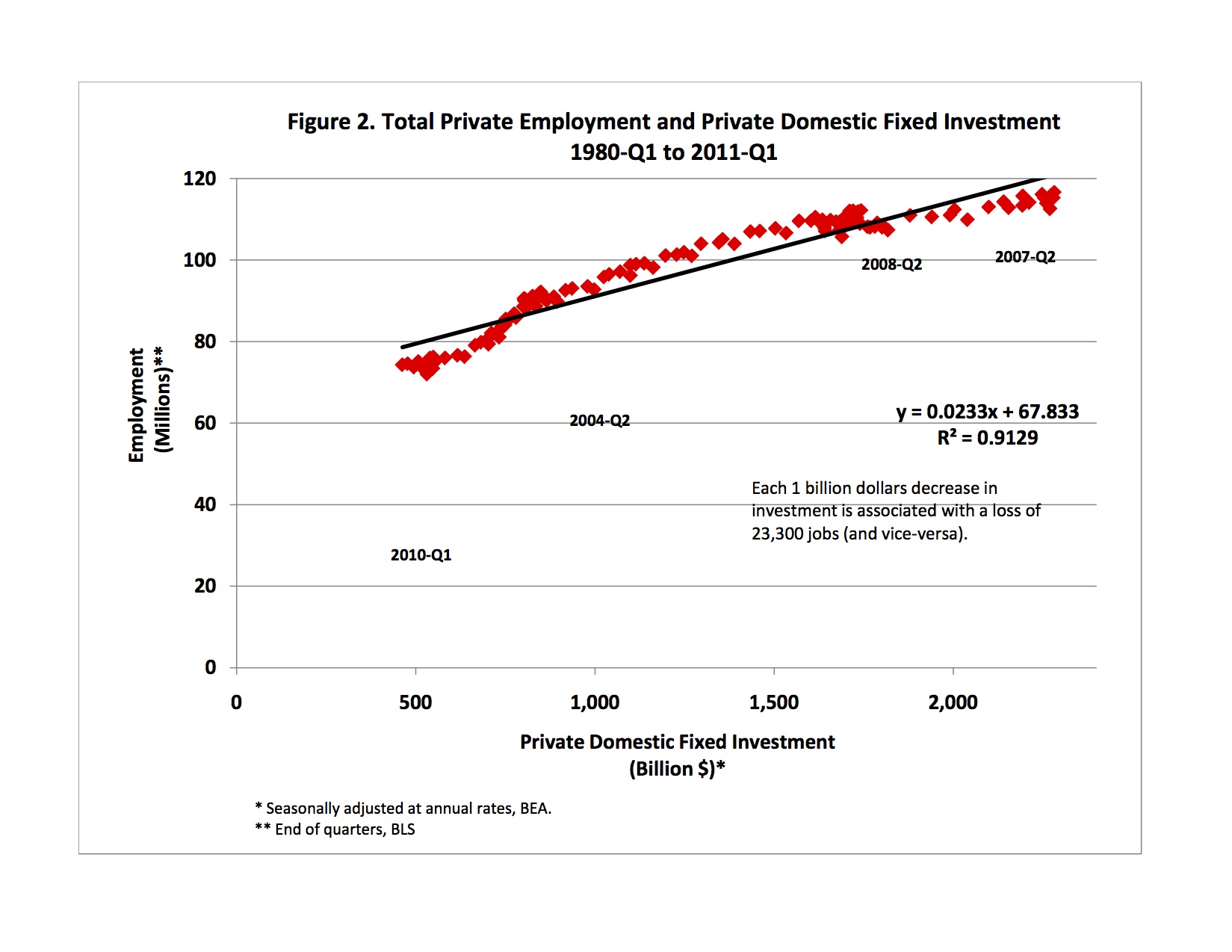

Today’s Bloomberg BNA Daily Tax Report story covers the uncertainty about depreciation allowances and how it is impeding new investment and job growth in the restaurant and retail sector. Legislation (H.R. 1265, S. 687) pending in both chambers would make permanent the 15-year depreciation schedule, which lawmakers and lobbyists said would provide businesses with the certainty they need to make long-term plans. The legislation is not scored, though a two year-plan covering tax years 2010 and 2011 that was enacted in December 2010 cost $3.6 billion over 10 years. “There are projects to renovate retail spaces that are being delayed because of the uncertainty in the tax law right now,” Bernstein said. “And those delays in remodeling projects cost jobs.” Delays cost construction jobs, construction materials, the potential for increased foot traffic and sales, and more employment in the store or restaurant, she said. Koenig said once the extenders phase is passed and substantive work on tax reform resumes, it is possible that lobbyists will ask lawmakers to look at an even shorter depreciation schedule. “We would argue that 15 [years] may even be too high,” he told BNA, noting that in the restaurant industry, the franchisee/franchisor agreement often states…

Continue reading