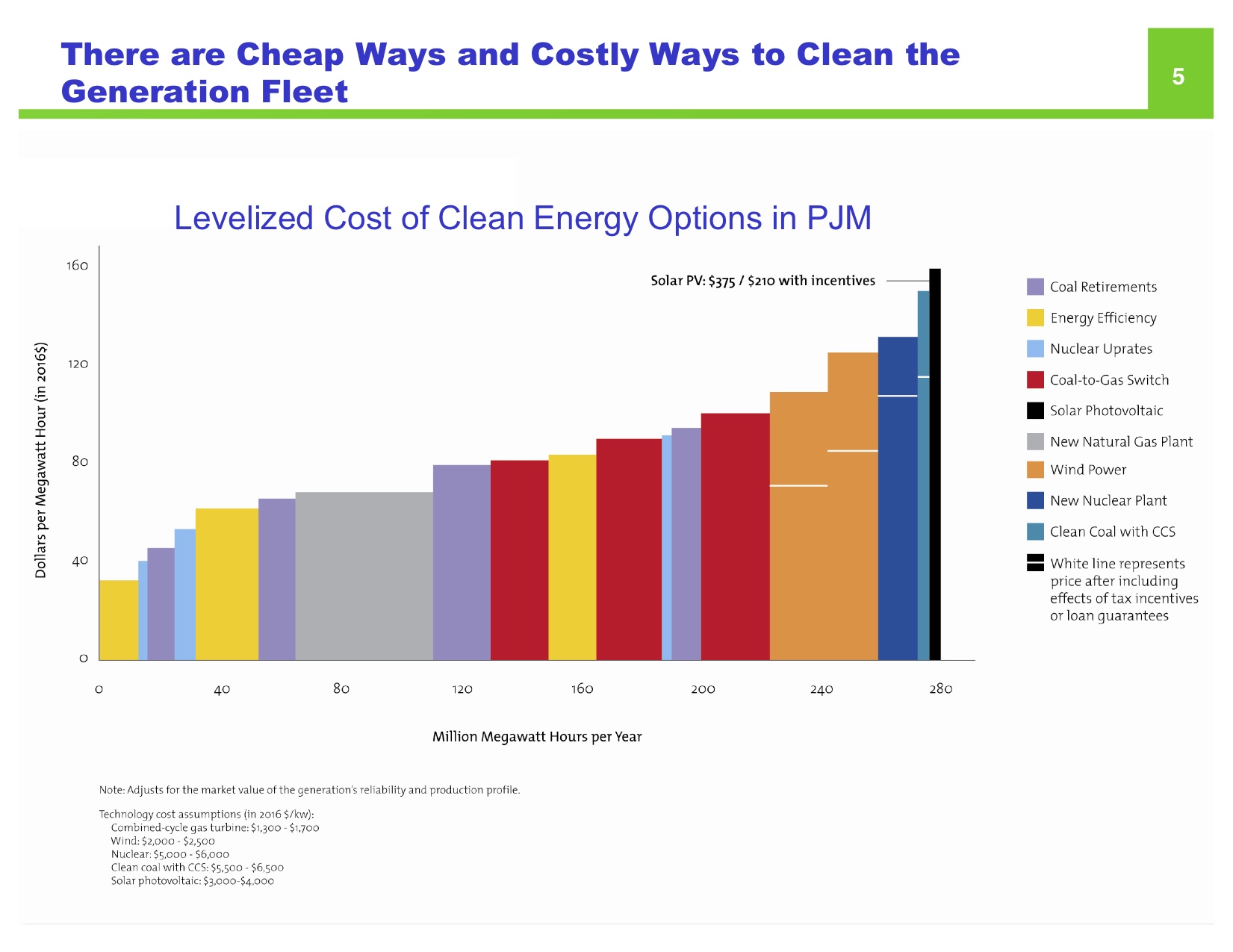

See my response to this week’s topic on National Journal’s Energy and Environment Experts blog. As lawmakers look for ways to cut spending in light of our crushing debt, federal subsidies should be scrutinized and cut back as quickly as possible. Renewables, which already receive a lion’s share of the Federal budget energy expenditures, tend to be extremely expensive sources of electricity as I demonstrated in the figure in my blog. Wind, solar and biomass can certainly play a complementary role in U.S. energy supply, but because of their cost, the intermittency of wind and solar, (the sun doesn’t always shine and the wind doesn’t always blow) and need for a backup energy supplies it is foolish to think that they will replace large amounts of our more traditional energy sources in the next 10 to 20 years. Heavy subsidies for renewable energy and alternative fuel vehicles when more cost-effective and efficient energy sources are available will further only delay our economic recovery. As congress weighs the real value of energy subsidies, it should also pursue policies that will allow for expanded capacity like allowing increased access to both off-shore and on-shore areas for drilling and exploration. This would have a positive impact…

Continue reading