Stunning New Propaganda From Anti-LNG Exports Group

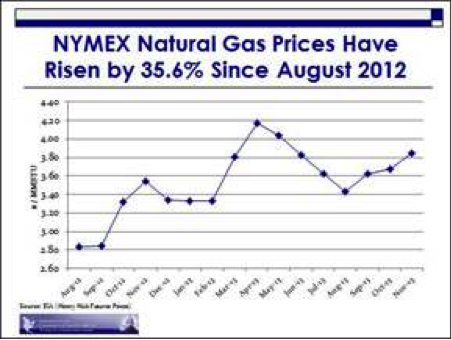

The Industrial Energy Consumers of America circulated to Capitol Hill this week a document entitled, “Five LNG Export Facilities; Natural Gas Prices Up 35.6 Percent; Cost of $25.8 billion”. The document contained talking points built on cherry-picked data that is so misleading you have to see it to believe it… ANTI-LNG MYTH #1: Natural gas prices are on the rise and therefore the department of Energy must delay LNG export applications. Pasted below is ICEA’s graph it uses to justify further delay of LNG export approvals. It looks like gas prices are on the rise… right? Wrong! Natural gas prices often reflect short-term seasonal and political changes; however, the huge increase in supply in recent years has brought natural gas prices down to the low levels of the early 2000’s as shown in the graph below: Source: http://www.eia.gov/dnav/ng/hist/rngwhhdd.htm ANTI-LNG Myth #2: The Department of Energy must redo its study. ICEA writes, “DOE is basing its LNG export decisions on domestic demand assumptions that are now three years old, and do not take into consideration that the EPA GHG rule will restrict use of coal in the power generation sector.” This statement is misleading; according to data from the EIA, even…