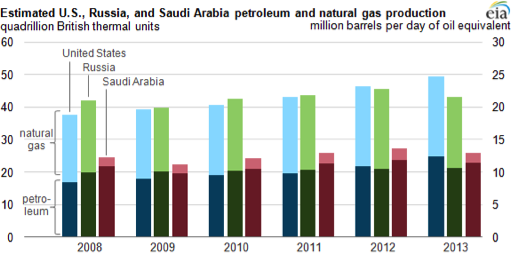

New Study Says Oil Exports Would Be a ‘Win, Win’ for U.S. Economy and National Security

Lifting the restrictions on U.S. crude oil exports would lead to further increases in domestic oil production, result in lower gasoline prices and support millions of additional jobs, according to a comprehensive new study commissioned by the Energy Security Initiative (ESI) at Brookings in coordination with a macroeconomic study contracted from National Economic Research Associates (NERA) Economic Consulting. The production boom from shale plays across the country, such as North Dakota and Texas, have sparked serious debate on what we should do with our new energy reality of abundant crude oil supply. To shed light on how our Administration should move forward with this new abundant energy source, the ESI partnered with the National Economic Research Associates (NERA) to examine the economic and national security impacts of lifting the ban on crude oil exports. And their findings were clear: it is time to match our policies to our current energy landscape. Economically, the study found that lifting the ban on crude oil exports from the United States will boost economic growth, wages, employment, trade and overall welfare. Each scenario used in the study model – delaying lifting the ban until 2015, lifting the ban only on condensates or lifting the…